Euronext Paris

Euronext Paris

Indices français

| Indices | Dernier | % |

|---|---|---|

| CAC 40 | 7 963,35 | -0,75 % |

| CAC ALL SHARES | 9 571,53 | -0,56 % |

| CAC NEXT 20 | 10 943,89 | -0,39 % |

| CAC SMALL | 11 506,73 | -0,64 % |

| SBF 120 | 6 019,86 | -0,73 % |

Indices EU

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

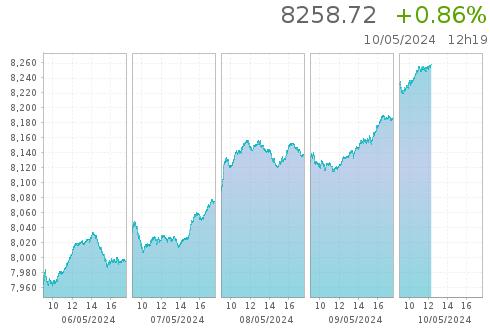

| EURONEXT 100 | 1 487,90 | -0,86 % |

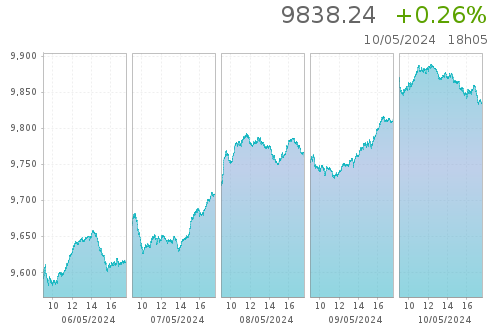

| CLIMATE EUROPE | 1 868,15 | -0,67 % |

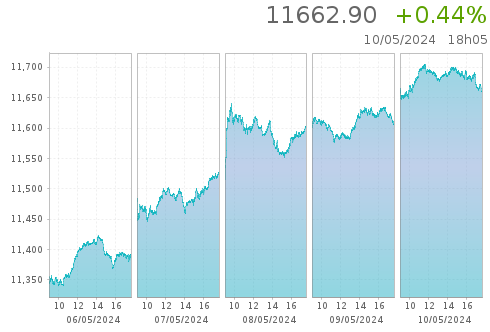

| LOW CARBON 100 | 158,93 | -0,56 % |

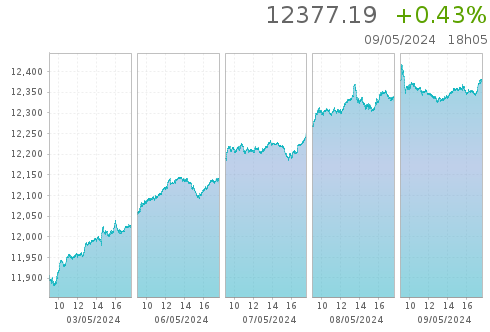

| NEXT BIOTECH | 2 049,07 | +0,32 % |

| ESG 80 | 2 021,87 | -1,00 % |

Taux de Change

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EUR / USD | 1,06476 | +0,03 % |

| EUR / GBP | 0,85619 | +0,05 % |

| EUR / JPY | 164,387 | -0,11 % |

| EUR / CHF | 0,96726 | -0,41 % |

| GBP / USD | 1,24343 | -0,03 % |

Marchés au comptant

Marchés dérivés

Communiqués reglementés

Euronext Paris

Pour plus d’information sur Euronext Paris

Visitez la section dédiée sur Euronext.com