Euronext Paris

Euronext Paris

Indices français

| Indices | Dernier | % |

|---|---|---|

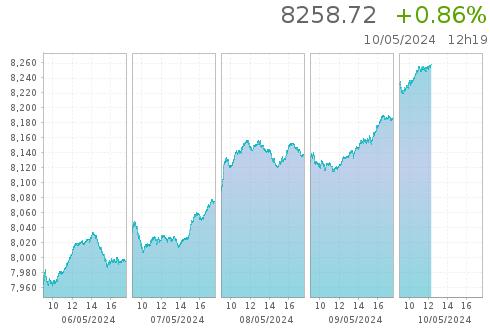

| CAC 40 | 8 046,32 | +0,37 % |

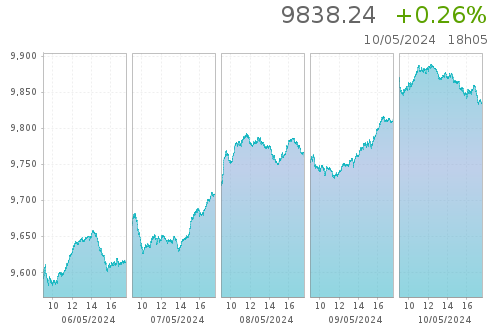

| CAC ALL SHARES | 9 636,71 | +0,52 % |

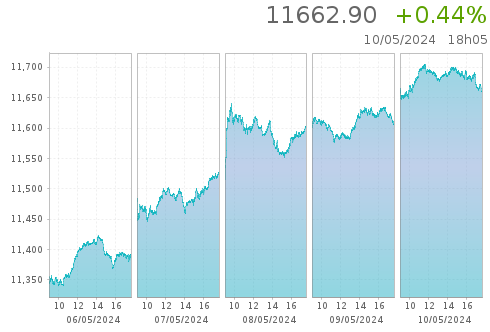

| CAC NEXT 20 | 11 075,89 | +0,94 % |

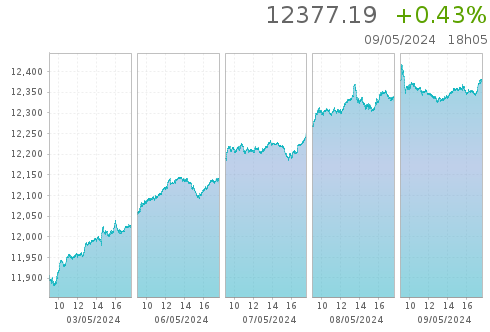

| CAC SMALL | 11 759,09 | +0,85 % |

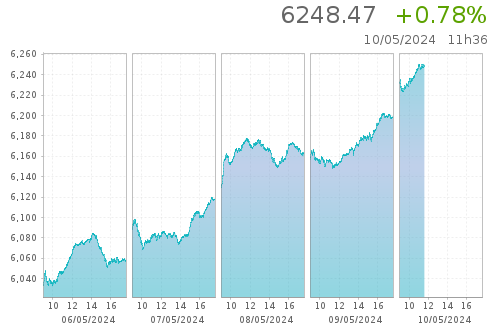

| SBF 120 | 6 081,14 | +0,42 % |

Indices EU

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EURONEXT 100 | 1 514,98 | +0,67 % |

| CLIMATE EUROPE | 1 916,48 | +0,82 % |

| LOW CARBON 100 | 162,47 | +0,70 % |

| NEXT BIOTECH | 2 062,85 | -1,34 % |

| ESG 80 | 2 062,55 | +0,74 % |

Taux de Change

| Instrument-name | Last-price | Day-change-relative |

|---|---|---|

| EUR / USD | 1,07321 | +0,02 % |

| EUR / GBP | 0,85747 | -0,02 % |

| EUR / JPY | 168,1895 | +0,75 % |

| EUR / CHF | 0,97858 | -0,01 % |

| GBP / USD | 1,25159 | +0,04 % |

Marchés au comptant

Marchés dérivés

Communiqués reglementés

Euronext Paris

Pour plus d’information sur Euronext Paris

Visitez la section dédiée sur Euronext.com